WASHINGTON, D.C. (July 25, 2018) – Mortgage applications decreased 0.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 20, 2018.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) remained unchanged at 4.77 percent, with points decreasing to 0.45 from 0.46 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $453,100) increased to 4.72 percent from 4.66 percent, with points increasing to 0.31 from 0.30 (including the origination fee) for 80 percent LTV loans.

The average contract interest rate for 30-year fixed-rate mortgages backed by the FHA remained unchanged at 4.78 percent, with points increasing to 0.73 from 0.69 (including the origination fee) for 80 percent LTV loans.

The average contract interest rate for 15-year fixed-rate mortgages increased to 4.23 percent from 4.22 percent, with points increasing to 0.44 from 0.42 (including the origination fee) for 80 percent LTV loans.

The average contract interest rate for 5/1 ARMs decreased to 4.09 percent from 4.12 percent, with points decreasing to 0.29 from 0.39 (including the origination fee) for 80 percent LTV loans.

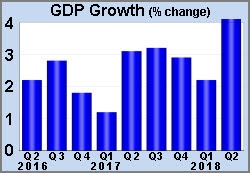

Friday’s release of second quarter gross domestic product (GDP), the broadest measure of economic growth, showed a massive increase of 4.1%, which was close to the expected levels. This was up from 2.2% during the first quarter and was the highest reading since the third quarter of 2014. Strength was seen in both consumer spending and business investment. Investors now will be watching to see if the underlying trend is closer to the first quarter or the second quarter levels.

Refinancing or Buying-

Home Financing doesn’t have to be Stressful.

We monitor real time interest rates, so our clients are able to access some of the lowest rates available.

With rates still historically low, poised to move higher, many would be home buyers are moving quickly to finance their piece of the American Dream.

Existing home owners have refinanced at least once, even twice. But there are still many who have not, due to either not wanting to deal with the stress of gathering documents and not sure of qualifying for a loan.

At North Atlantic you receive attentive personalized service

(see what our clients say).

Believe me it’s a great deal easier with our help and expertise. The average time to close a loan is about 30 days. We understand the guidelines and know what different lenders can do, which increases your opportunities for a fast easy loan with a great rate.

Don’t put it off any longer and start saving with a lower mortgage payment.

There’s no salesman to speak with only qualified mortgage experts.

For a Free Consultation:

Call or Email:

John Sauro

Ph: 877-794-5363

Email: JohnSauro@Gmail.com

Looking ahead, the important monthly Employment report will be released on Friday. As usual, these figures on the number of jobs, the unemployment rate, and wage inflation will be the most highly anticipated economic data of the month. Before that, the Core PCE price index, the inflation indicator favored by the Fed, will be released on Tuesday. The ISM national manufacturing index will come out on Wednesday, and the ISM national services index will come out on Friday. The next Fed meeting will take place on Wednesday. No change in policy is expected.

Source: MBA, Bloomberg, NAR